Crucial Wisdom for Accountants

In the dynamic landscape of the accounting profession, the adage “Understanding our clients isn’t just good business, it’s the soul of our accounting profession” resonates more deeply than ever. Beyond mere financial transactions and ledgers, the ability to comprehend the intricacies of a client’s needs and expectations has become a critical skill, not just for success, but for the very survival of accounting practices.

The Essence of Client Understanding

The realm of accounting is no longer confined to numbers alone; it encompasses a holistic understanding of the client’s business, goals, and challenges. Research journals and authentic papers underline the significance of this nuanced understanding. According to a study published in the Journal of Accounting Research, client comprehension involves delving into not just the financial aspects but also understanding their industry, market dynamics, and long-term objectives.

Factors to Consider

Communication is Key: Establishing effective communication channels is the bedrock of understanding. A research article in Accounting Today highlights that frequent and transparent communication fosters a strong client-professional relationship.

Tailoring Services: Each client is unique, and a one-size-fits-all approach doesn’t suffice. A paper from the International Journal of Accounting Research emphasizes the need for customized services based on individual client requirements.

Proactive Problem-Solving: Anticipating potential issues before they escalate is crucial. Research from the Journal of Accounting and Economics suggests that proactive problem-solving enhances client satisfaction and loyalty.

The Challenge of Limited Resources

Curiously, amidst the growing emphasis on client understanding, there remains a scarcity of research material addressing these concerns. This dearth is a challenge the accounting industry grapples with. While financial journals abound, there is a noticeable gap in literature addressing the human aspect of client relations.

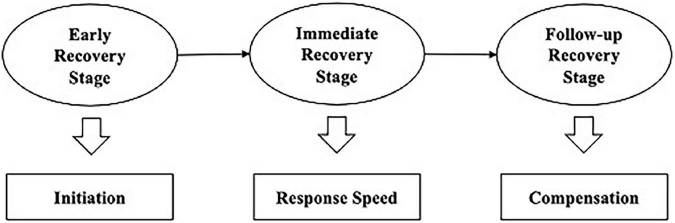

The Impact of Service Recovery Stages in the UK Accounting Industry

In the UK accounting landscape, service recovery stages play a pivotal role in shaping client perceptions. A white paper from the British Accounting Review indicates that the recovery process after a service failure can either deepen client loyalty or lead to irreparable damage. Timely and effective resolution, coupled with empathetic communication, forms the crux of successful service recovery. The study delves into relationship repair dynamics in accounting, introducing the revised service recovery cycle model (Figure 1). The model highlights three key stages: (1) initiation in the early recovery phase; (2) response speed during immediate recovery; and (3) compensation in the follow-up recovery stage.

In the early recovery stage, proactive efforts go beyond addressing complaints, encompassing situations where customers may not formally complain. Research emphasizes that initiating recovery at this stage demonstrates courtesy, honesty, empathic understanding, and respect, positively influencing customer perceptions.

The immediate recovery stage stresses the importance of response speed, with promptness impacting consumer satisfaction. Prolonged recovery time leads to negative consequences like unfavorable word-of-mouth and lower recovery satisfaction. Swift responses to complaints or negative reviews and effective service remediation mitigate these impacts.

The follow-up recovery stage acknowledges consumer perception of inequity post-service failure. Offering suitable compensation, such as discounts or refunds, aligns with social exchange theory, balancing costs and benefits in relationship recovery. Compensation, highlighted as a crucial recovery dimension, plays a vital role in restoring equity post-service failures.

Distinguishing service recovery from service failure, the latter encompasses core, interactional, and process failures, all of which can lead to dissatisfaction and negative word-of-mouth. Recognizing the critical need for recovery efforts in service failure situations, this study reinforces that service recovery is integral to customer satisfaction and loyalty in the accounting domain.

Retaining Clients Through Understanding

Client retention is a natural byproduct of a robust understanding of their needs. The personal touch, highlighted in an article by Accountancy Age, stresses that clients are more likely to stay loyal when they feel genuinely understood and valued.

In conclusion, the art of understanding clients is not just a skill; it’s an ongoing commitment to evolve with their needs. As the accounting profession embraces this ethos, it not only safeguards against service failures but also lays the foundation for enduring client relationships. The journey from transactional to relational accounting is a path paved with client-centric insights, making it not just good business but the soul of our noble profession.

Ref:

https://journals.sagepub.com/doi/abs/10.1177/10946705231194006

https://thedailycpa.com/holistic-accounting/

https://online.maryville.edu/blog/accountants-7-skills-to-master/

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9014211/

https://www.getcanopy.com/blog/essential-skills-for-modern-accountants